Introduction

With the stock market moving fast today, you need stock analysis tools to easily and quickly make sense of complex data. Whether you’re an experienced trader seeking to elevate your trading strategies, a small business owner in need of professional at-home investing tools or a casual investor looking for more profitable investor options, the best resources can make a world of difference.

In this post, we’ve listed top 7 stock analysis software and applications for 2025 which were carefully selected to help you navigate through your journey of trading or investing. Each offering has been rated on these metrics and more, which provides you with the information you need to make an informed decision on the right solution for your needs. Jump in and find out what those tools are that help you with your stock analysis and put you on the path to financial mastery!

Website List

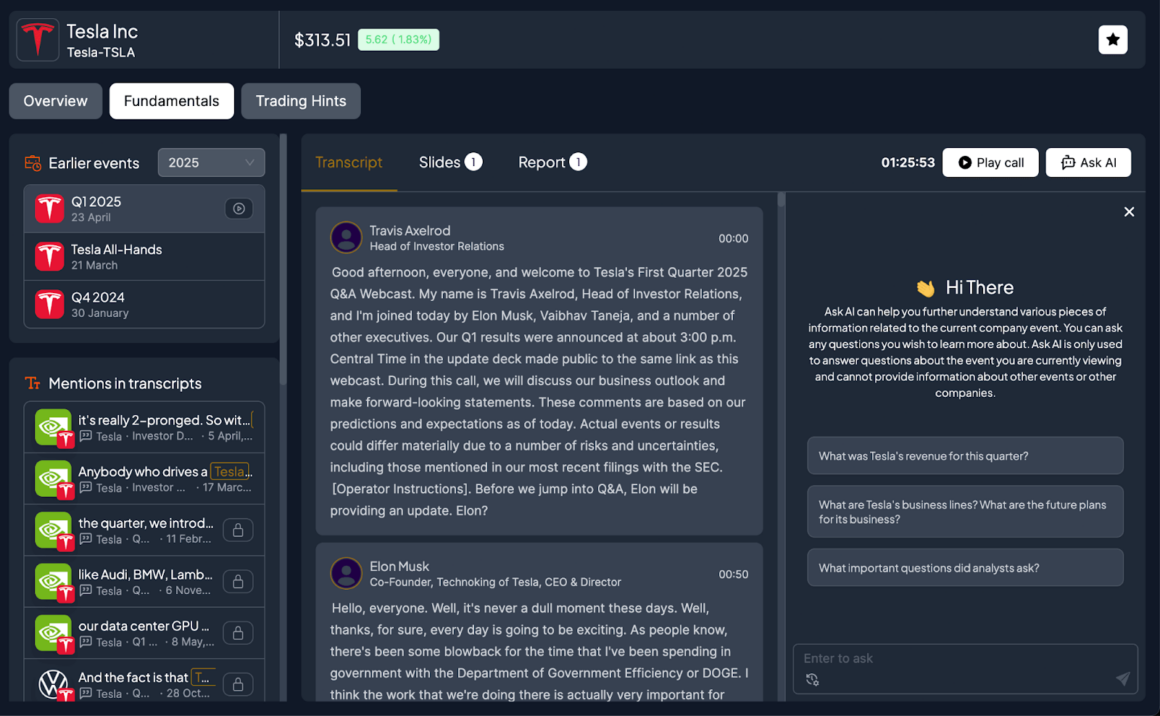

1. BestStock AI

What is BestStock AI

BestStock AI is an AI stock analysis platform that provides you with fast, reliable and in-depth market information. Its bread and butter is automating financial analysis by turning “actionable insights” and prescreened research into information that professionals and long-term investors can use to make strong decisions. With a corporate financial intelligence and disruptive data visualization, BestStock AI makes investing easy – giving you the tools to plan ahead for better investments. It also has an options profit calculator, which calculates profit or loss across strikes and expirations while accounting for premium, fees and IV; it also identifies break-even points to help you select the best strategy.

Features

- Automates financial data processing for actionable insights using NO manual effort through AI-based analysis

- Corporate financial intelligence – comprehensive full US stock financials and earnings transcripts

- Cutting-edge statistical and business analysis tools to deepen understanding of the market

- Intuitive user interface and data visualization tools for improved interpretation and decision-making

- It is updated with new features, functionality and fixes developed from user feedback on an ongoing basis to improve the site

Pros and Cons

Pros:

- Financial analysis assisted by AI that automates data processing for actionable insights

- Access to US stock market news, financials Easily known your stocks earnings transcripts and analysis of the latest gainers/losers.

- Easy-to-use research experience that is designed for professionals and experienced investors

- Powerful data visualization tools that help users understand complex financial details

Cons:

- Possibly more expensive subscriptions than some of the more budget-friendly options

- There is not as much mobile app functionality.

- Limited offline functionality for data viewing and analysis

2. Tickeron

What is Tickeron

Tickeron is a platform providing AI-powered stock market, and cryptocurrency analysis assisting everyone on the path to better trading. It’s focus is to educate and inform investors with timely, non-biased and unique market speculation insights covering stock trends, profitability in trading options and analytics of companies that are undervalued. Utilizing the latest in artificial intelligence-based technology, Tickeron seeks to empower all users with precise and informative trading opportunities.

Features

- An intuitive interface helps you boost productivity and save time, as well as reduce learning curve.

- Strong security capabilities to protect sensitive data and meet compliance regulations

- Enhanced workflows that suit your specific business requirements

- A wide range of integration with tool and site builders

- Efficient customer for quick support and guidance

Pros and Cons

Pros:

- Implement all functions users would need

- Easy to use interface which makes the on-boarding process very smooth

- Strong community backing with lots of resources and documentation

- New and improved features; performance improvements

Cons:

- Certain more advanced features can take significant learning time to use effectively

- Third-party integrations may be not available

- Costs can add up quickly with premium features and add-ons

3. Stockpulse

What is Stockpulse

Stockpulse is a leading for one innovative company in Germany, which has sophisticated AI (Artificial Intelligent) based technology that analyses social and financial news media for social sentiment to help power investment decisions. It primarily is intended for the analysis and evaluation of markets, providing actionable intelligence to increase regulatory compliance and trading strategy ideas. Using AI-generated summaries and sentiment analysis, Stockpulse provides clients such as Deutsche Börse AG and Moody’s access to the financial world in a more useable form.

Features

- Actionable insights that empower real-time decision-making through live social media monitoring

- AI-enhanced sentiment analysis for better market surveillance and fraud detection

- Extensive daily reports and supportive market analysis for risk assessment

- Direct integration with your financial systems for efficient operations

- Improved compliance by proactively detecting and reporting anomalies

Pros and Cons

Pros:

- Real-time social sentiment of financial market for better decisions making

- They help by identifying market manipulations and fraud through sophisticated AI monitoring

- Provides pithy, actionable insights in daily reports to better analyze the market

- Promotes regulation compliance and market integrity of financial institutions

Cons:

- Investment may be substantial for deployment and integration

- An overreliance on social media data may create a green monster of information overload

- Offline downloads offered for the users who needs access without internet

4. AlphaInsider

What is AlphaInsider

AlphaInsider is an original social eco system between traders and investors about trading with all the strategies. It aims to facilitate traders through access to strategically selected tools: high-quality trading strategies that enhance your profit-making ability and assist you in achieving success. With team spirit and drive all the way, AlphaInsider empowers you with tips and tricks to resolve and make a break in the world of trading.

Features

- User-friendly design that is easy to navigate and accelerates productivity

- Strong security measures to prevent sensitive data from falling into the wrong hands, and ensure compliance

- Real-time tools for collaborating with teammates and project efficiency

- Reporting provides insight at a glance to help you understand how your money has been spent

- Multiple integration capabilities, designed to integrate simply with current systems and procedures

Pros and Cons

Pros:

- Insider-oriented edge: Consolidates Form 4 trades, option grants & 10b5-1 plan disclosures to highlight high-conviction buys/sells and governance signals.

- Sophisticated screening and anomaly detection: Filter by role, ownership change, transaction size, sector/industry and timing; flags potential outliers.

- Contextual performance analytics: Post-trade return analyses, hit-rate stats by insider type and sector baselines provide a measure of the strength of the signal.

- Timely notifications and worfklows: Real time alerts, watchlists, blackout calendars/lockup for CSV/API exports and seamless research pipelines.

- Clear data normalization: De-dupes amended filings, reconciles derivatives vs – common stock and adjusted for split/awards to eliminate misreads.

Cons:

- Signal noise and misinterpretation: Lots of insider trades are about diversifying, or tax planning, or a preset plan — terrible as stand-alone buy/sell signals.

- Glimpses of a coverage and latency gap: lag in filing; US-centric focus; less depth for small caps, and not much on international.

- Less focused than an insider: Less depth in fundamental research, alternative data sets, macro / news vs a full-features research terminals.

5. Moneycontrol

What is Moneycontrol

Moneycontrol is India’s leading financial information source for Live Stock Price, Stock/Share Trading news, Stock/Share Markets Tips, Sensex, Nifty. The mission statement in itself is to equip investors and financial enthusiasts with a full-package set of data, research and information that will help drive their investment decisions. The offers the latest news, views and analysis of the financial world including live commentary that covers stocks, gold, forex as well as other markets so you are always ahead.

Features

- IPO oversubscribed with strong investor confidence and demand

- Strong retail participation with 85% of the issue being subscribed, indicating a very broad base of participants

- Price/Index /Gifty Level/CMP Based Target & recommendation for Short/Long Term Investing GMP Comparison with Peer Group and Industry Peers for Sound Investment decision making

- Strategic visibility provided by substantial order books indicating attractive long-term growth potential

- Positive market reception, which we could observe in the form of share-price spikes after IPO indicating good performance

Pros and Cons

Pros:

- Retail portion subscribed 8.68 times, indicating the confidence of retail investors

- Retail portion booked at 85 per cent

- Biocon stock rallied 10% in two days, on market optimism

- Solid quarterly results at companies such as Biocon are luring brokerages and encouraging them to raise their target prices

Cons:

- GMP (Grey Market Premium) is less than 1, may dissuade some investors

- Worry’s over something may haunt the chancellor of Al-Falah and affect investor confidence.

- Some profit booking seen in Groww stock after a strong debut indicates market volatility

6. Webull

What is Webull

Webull is an online brokerage offering low-commission fees while also enabling investors/traders to easily trade most of the financial markets, such as stocks, option trades, ETFs and even cryptocurrency. It’s primary focus is to support and promote more informed investment decisions through the utilization of sophisticated trading platforms as well as educational tools. Webull offers an intuitive user interface, as well as powerful tools that provide deep insights to users looking to trade stocks, ETFs and options.

Features

- Full availability of a full-array of investment products including equities, etfs and options and the debut of crypto funds to enrich an easy investing experience!

- The most intuitive and powerful, feature rich app – so you never miss an opportunity to invest Trade like the pros with access to real-time quotes, charts, advanced order types and more.

- User-friendly mobile and desktop apps for effortless trading anywhere on any device

- A variety of cash management options with competitive APY, including recurring investing to grow your money over time

- Secure technology to protect all your investment transactions

Pros and Cons

Pros:

- Wide variety of investment products: Stocks, options, ETFs and digital currency

- Easy to use with the friendly interface and clear navigation sections

- Full range of trading and advanced capabilities (live quotes, paper-trading tools)

- Provides new features and improvements, increasing the user experience

Cons:

- Features for premium trading: More expensive options may have a lower-cost counterpart_trait budget platforms.

- The mobile app doesn’t work as well as the browser version for some users

- Restricted investment choices such as fixed income and money market funds may not cover all investor needs

7. Earnings Whispers

What is Earnings Whispers

Earnings Whispers is a financial website that offers information and analysis for traders and investors about Q1 earnings reports. Its primary function is to monitor market feelings surrounding the earnings announcements, providing investors with an uncommon view as to which companies are attracting the most interest along with their subsequent performance over earnings. We help you make more informed decisions with up-to-date information on the latest news around earnings announcements.

Features

- In-depth coverage of top earning news, events and sentiment trends

- Real-time follow-ups of earnings conversations to stay on top of market sentiment

- Visual sentiment indicators to show the positive and negative earnings expectations

- Going deeper into the headlines of positive expected earnings to find potential plays

- User-friendly UI made for easy navigation and access to key information

Pros and Cons

Pros:

- Gives light to timely signs of earnings sentiment to make better investment decisions

- Recent positive earnings are being highlighted, fueling focus on successful companies

- Reports on profit discussions that pique interest, raising market awareness

- Top earnings news at your fingertips for rapid analysis and timely updates

Cons:

- Limited earnings detail might necessitate additional research

- Reteeters in thrall to the newest data could themselves turn on a dime

- May not include all companies of interest (may not be comprehensive)

Key Takeaways

- The top stock analysis software for your investment strategy or market?

- Historical performance and fundamental analysis can serve as more predictive indicators of trading performances than just market prices.

- Integration: integration with your brokerage and financial tools can significantly improve trading efficiency.

- User interface, ease of use and available learning material are very important for new or even experienced investors to reach their full potential.

- Regular releases and the addition of new tools suggest a dynamic product that evolves with market demands.

- Security protocols and compliance to regulations ensure that your investment information and personal info is safe.

- Vibrant community forums and full documentation can help expand your knowledge on stock analysis tools.

Conclusion

All in all, this comprehensive top 7 of the best stock analysis software will help you make an informed decision with whom you want to work and to speed up your scanning skills in a dynamic market. Both have their own unique strengths and capabilities, so it’s important to put some thought into what you need out of the box in a playback device and what your budget is, long-term goals are, etc. Whether you’re already comfortable investing or just learning the ropes, the proper tools can help you make better financial decisions.

The stock-analysis terrain is changing quickly, and new tools and enhancements appear all the time. We suggest you begin with those solutions that most closely meet your immediate requirements, but keep an eye on their potential to develop and adapt as your investment strategies mature. Keep in mind that the highest priced product is not always the most effective, and the same goes for no-frills software – it may be perfect for your requirements.

Make use of free trials and demos to try these tools out for yourself, and if you have any questions then remember that there are customer support teams that you can contact. The key stock analysis tool that works is one that can help you multiply your success dozens of times over, and which will make countless hours spent researching and evaluating all worthwhile. Begin your journey deep into the analysis of your stocks today and arm yourself with the knowledge to succeed in the financial markets.