With their unmatched accessibility and efficiency, loan applications have completely changed the financial scene. These apps offer a quick and user-friendly replacement for traditional lending methods, streamlining the application process and also speed up the approval process. In this article, we’ll take a closer look at how to build a loan app and investigate its key use cases and advantages.

You can also visit this Topflight link to get more information about loan app development: https://topflightapps.com/ideas/how-to-create-a-loan-app/.

Loan Apps Or Fuel For Post-Pandemic Economies

Following the global pandemic, loan apps have become important drivers of economic recovery. They have played a vital part in helping people and businesses get emergency funding during tough times. These applications have revolutionized the borrowing landscape and sped up access to capital, providing economies with the liquidity they desperately needed to regain their stability.

Loan Apps In A Nutshell

Before you start to build a loan application, its necessary to know how these apps operate and what technologies these apps use:

What Are Loan Apps?

Through a quick process of registration, data verification, and profile completion, a money-lending app offers quick loans to its users. Traditional bank loans have lost ground to the convenience of smartphone apps in an age of digital innovation. Quick loans without in-person meetings were in high demand during the pandemic. This made these platforms the go-to option for resolving financial issues.

How These Apps Work

Here’s how these apps work: Borrowers make loan requests after passing a security check. These requests are then evaluated and approved by the platform. Then, lenders who are ready to lend can go through the list of requests to decide whether to approve or deny them. The platform receives a portion of the transaction and sometimes recurring fees. However, because there is no middleman, the interest rates and terms are fair for all parties involved.

Information About P2P Loan Apps

A P2P lending app connects lenders and borrowers directly through the app. Lenders are willing to provide financial assistance to borrowers in exchange for a return on their investment (or “interest”).

Peer-to-peer loan lending app development is the most common type of development process these apps use since there are no middlemen involved in the loan procedure, such as banks or loan brokers.

How To Build A Loan App

In order to make a money-lending app with high user retention, be mindful of the following factors:

Defining Loan App Strong Points

Privacy

Trusted loan apps protect sensitive personal and financial data with robust encryption and secure protocols, ensuring user information continues to be confidential and protected from unauthorized access. Transparent privacy rules define data collection, use, and storage, promoting confidence between users and the app provider.

Security

When it comes to lending apps, the most reliable ones always put safety measures first. Strict authentication mechanisms, such as biometric verification, restrict unwanted access. Regular security updates shield users’ financial data from developing risks or threats.

Different Lending Options

Loan apps provide a variety of lending alternatives to fulfill a variety of financial demands, ranging from personal loans to business finance. Users can set loan amounts, repayment terms, and interest rates.

Choosing The Type Of Loans Availability

Personal Loans

Personal loans are a versatile option for a variety of unique financial demands. Personal loans provide financial flexibility in various situations, from dealing with unexpected medical costs to paying for a dream vacation. They are typically offered with fixed interest rates and predictable repayment terms, helping borrowers to organize their budgets properly.

Business Loans

Business loans are developed for entrepreneurs and small startups who need financial assistance. Business loans should help you expand your operations, buy equipment, or cover operational costs.

These loans can have a variety of variables, such as adjustable interest rates and repayment programs that are tailored to your company’s goals and circumstances.

Developing Loan App Structure

Developing a functional loan app involves splitting it into several sections that cater to various responsibilities in the borrowing process:

Admin Options

The admin panel allows you to manage the app’s operations. Admins monitor loan approvals, manage user accounts, and verify profiles. They are also in charge of app settings, guaranteeing smooth functionality and regulatory compliance.

User Options

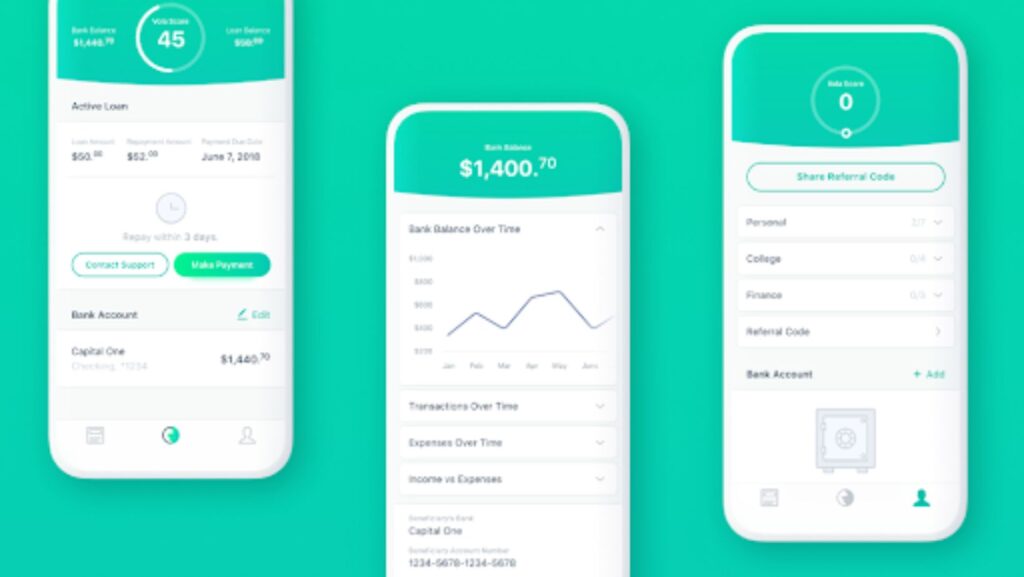

Users interact with the app’s front interface, accessing a variety of features. They can register, provide required papers, and apply for loans. The app allows users to track the status of their loans, evaluate terms, and manage repayments. User interfaces are created to make navigation and interaction as simple as possible.

Lender Options

Lenders participate in the loan process using dedicated features. They examine loan applications, evaluate borrower characteristics, and make loan approval decisions. Lenders can define their conditions, interest rates, and preferred borrower profiles.

Starting A Loan App Development

Loan lending mobile app development requires extensive market research, identifying its goal and target audience, and building a user-friendly interface. Development and testing ensure functionality and regulatory compliance, resulting in a targeted app launch supported by successful marketing. User feedback drives continual improvement, while scalability and maintenance ensure a consistent user experience and adaptability to ever-shifting demands. We hope our guide on how to build a loan app will help you a lot in your desired loan app creation.